Transfer Of Ownership

Transferring Ownership of Property

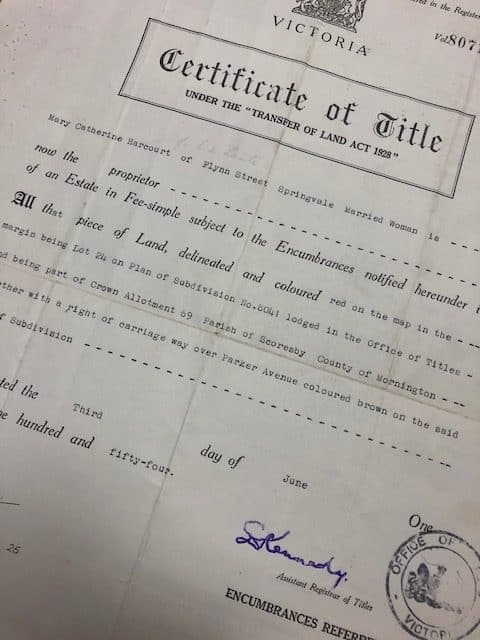

A Transfer of Ownership is when you are changing the name/s on Title.

For example:

- One person transfers ownership to two (ie husband to husband and wife);

- Two people transfer ownership to one (ie husband and wife to wife);

- Mother and Father transfer ownership to Child or Children (related parties transfer)

- Deceased party transferred to executor

Non-Dutiable Transfers When Property is Your Principal Place of Residence

A transfer of ownership between husband/wife and domestic partners are exempt from stamp duty when the transfer relates to the property they are actually living in and remains as their principal place of residence.

Please note that following completion of the Transfer of Ownership the newly appointed owner is required by State Revenue Office to remain in the property for a minimum of 12 months.

Stamp Duty is Assessed for Investment Properties

When there is a transfer between parties (including spouses, domestic partners and related parties) on an investment property, we will present all necessary documents to STATE REVENUE OFFICE who will then assess the correct stamp duty to be paid.

Please note that State Revenue Office will only accept either of the following Market Appraisals:

- Appraisal from a Real Estate Agent confirming the current market value of the property. This Appraisal must be signed by a Licensed Real Estate agent and his/her Licence Number shown near their signature, OR

- A Property Valuation Report approved by The Australian Property Institute (API) and signed by an AAPI – Certified Practising Valuer.

You can use the stamp duty calculator on State Revenue’s website.